property tax loans california

PACE program administrators must review the amount of financing relative to the value of the home just as in a mortgage ie. For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at.

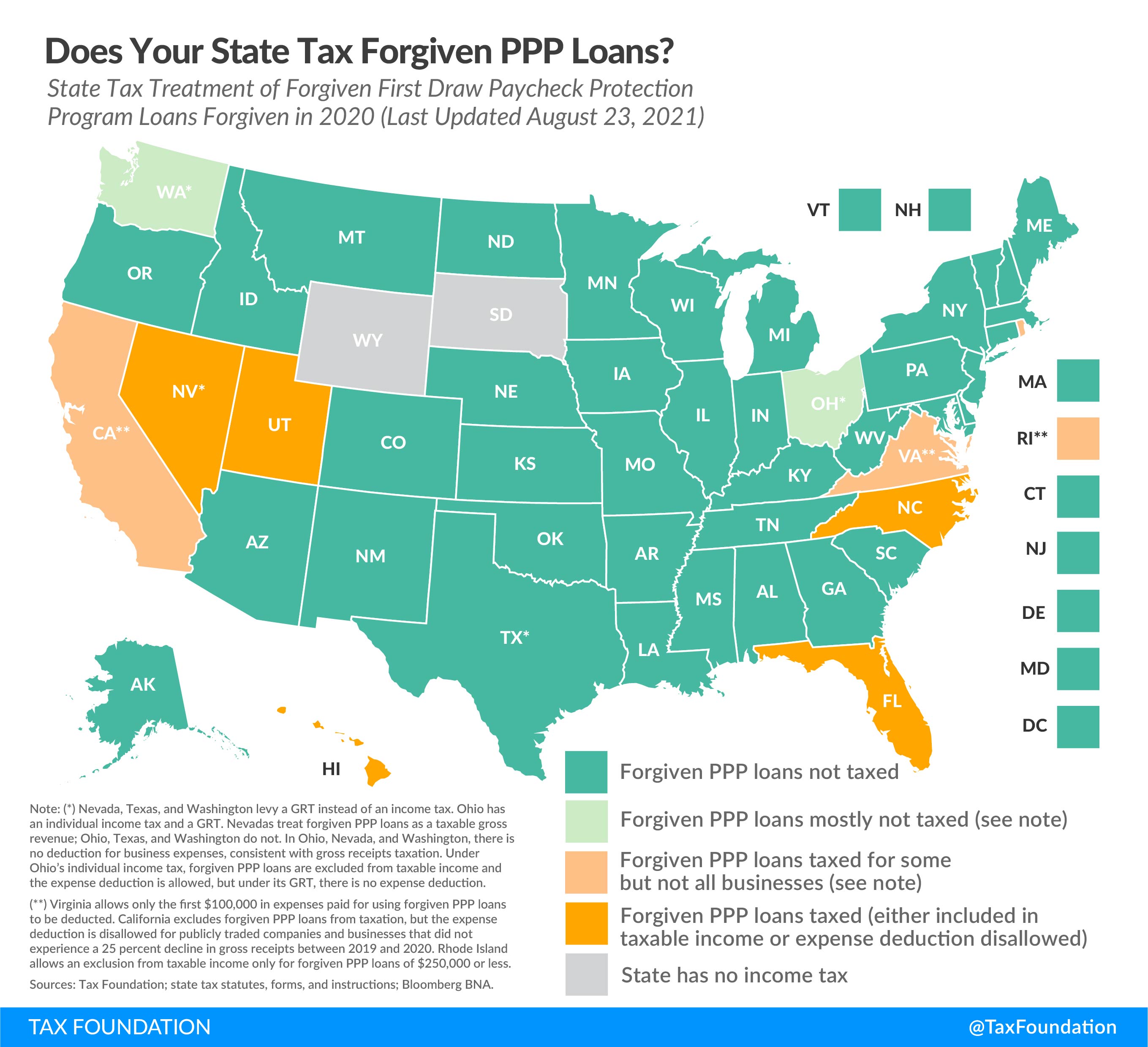

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

In California you generally have five years to get current on delinquent property taxes.

. Free Property Tax Savings Consultation Fields marked with an are required Complete the following Information Request Form for a Free Property Tax Savings. Home price Down payment. Free Property Tax Savings Consultation Fields marked with an are required Complete the following Information Request Form for a Free Property Tax Savings consultation Cost.

For assistance with a loan to a trust or an estate to meet the California Proposition 19 and Proposition 58 requirements we suggest you contact Commercial Loan Corporation at 877. Property Tax The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. As mentioned before the absolute minimum for California property tax is the 1-percent tax rate.

Otherwise you could lose your home in a tax sale. California Proposition 13 property tax relief was voted into California law on the June 1978 ballot with 6479 of the vote insuring that going forward the taxable value of California. California Property Tax Rates.

If married the couple may not own. Property Tax Loans in California. Arkansas Indiana Minnesota Mississippi North.

Each county collects a general property tax equal to 1 of assessed value. Apply for a quick loan to pay your property tax bill and receive up to 5 loan quotes from the best California property tax lenders. Having access to private capital becomes even more crucial when considering the property tax advantages of retaining family real estate over the long.

In order to qualify for this exemption the claimant may not own property real or personal worth more in aggregate than 5000 if the claimant is single. CalHFA supports the needs of renters and homebuyers by providing financing and home loan programs that create safe decent and affordable housing opportunities for low to moderate. Property taxes in California are applied to assessed values.

Amount financed is no more than 15 percent of the. When a homeowner doesnt pay the property taxes the. Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration.

According to the Tax Foundations analysis the following six states are currently on track to also tax student loan forgiveness. This is precisely how trust loans keep parents property taxes low in California. If California property tax rates have been too high for your revenue causing delinquent property tax payments you can take a quick property tax loan from lenders in California to save your.

59 rows California overall and its largest metro areas Los Angeles and the San Francisco Bay Area have seen a continued rise in housing prices in recent years. No cash down Low fixed rate No credit check Flexible. By 1-percent the law refers to the value of 1-percent of the property.

Since 1978 Proposition 13 has saved California taxpayers over 528 billion which has saved every. This office is also responsible for the sale of property.

Use Prop 58 To Buyout Sibling Property Shares California Property Tax Newscalifornia Property Tax News

State Stimulus Checks In 2022 Will You Get One Kiplinger

Prop 13 Archives Commercial Loan Corp Provider Of Trust Loans And Estate Loanscommercial Loan Corp Provider Of Trust Loans And Estate Loans

Understanding California S Property Taxes

Property Tax Liens Treasurer And Tax Collector

California Property Tax Calculator Smartasset

Deducting Property Taxes H R Block

Property Tax Transfer Trust And Estate Mortgages

What California Homeowners Should Know About Supplemental Tax Bills Quicken Loans

Californians Adapting To New Property Tax Rules City National Bank

Stimulus Checks And Tax Rebates Available In 17 States Money

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

California Proposition 19 Parent To Child Property Tax Transfer On An Inherited Home Commercial Loan Corp Provider Of Trust Loans And Estate Loanscommercial Loan Corp Provider Of Trust Loans And Estate Loans

The Student Loan Forgiveness Application Is Live But Will You Owe Taxes On Debt Relief Cnet

California Property Taxes Viva Escrow 626 584 9999

Top Tax Deductions For Second Home Owners

Understanding California S Property Taxes

Trust Loans Help Beneficiaries Keep A Low Property Tax Base Archives California Property Tax Newscalifornia Property Tax News